Most pharmacies carry hundreds of medications, but generic stocking strategies are what keep them profitable. It’s not about having every drug on the shelf-it’s about having the right generics, in the right amounts, at the right time. If you’re running a community pharmacy, you know the pain of running out of metformin on a Monday morning or sitting on expired bottles of lisinopril because you overordered. These aren’t just inconveniences-they cost money, erode trust, and hurt your bottom line.

Here’s the hard truth: 90% of prescriptions filled in the U.S. are for generic drugs, but they make up only 20% of total drug spending. That means your inventory isn’t about volume-it’s about efficiency. The goal isn’t to stock more generics. It’s to stock smarter.

Why Generic Stocking Isn’t Just ‘Buying Cheaper Drugs’

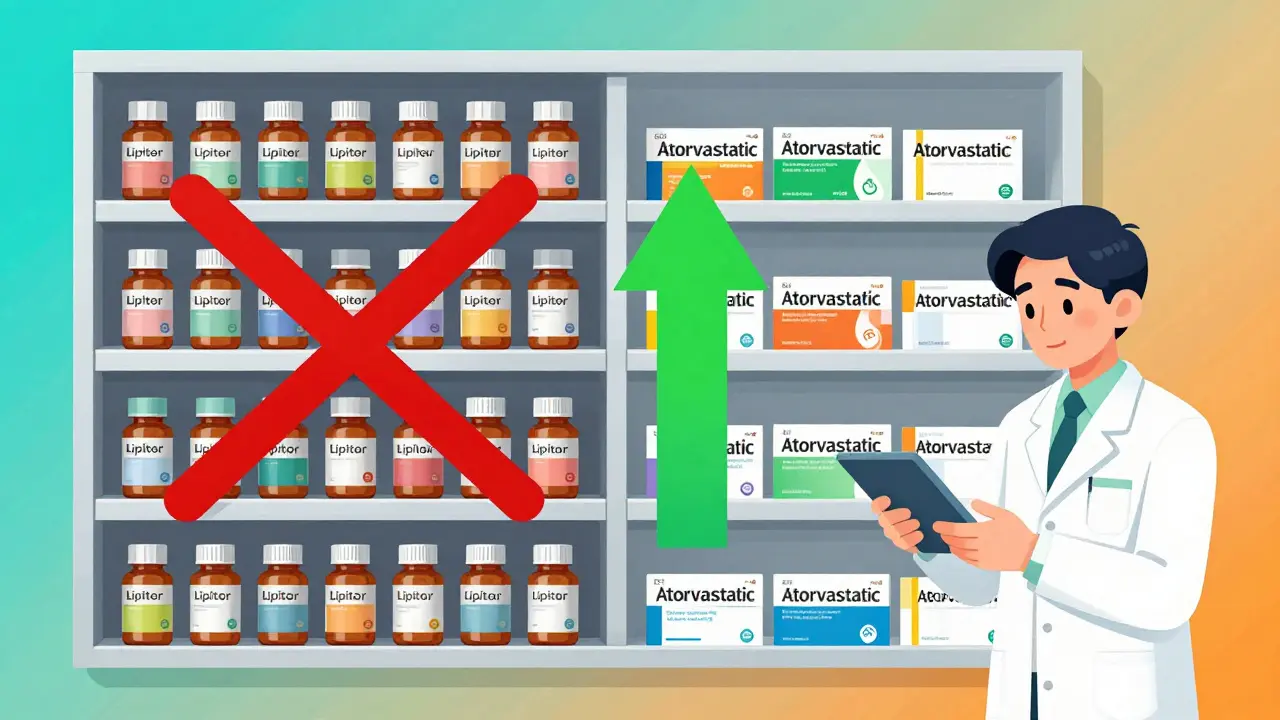

Generic drugs aren’t just cheaper versions of brand-name pills. They’re dynamic products with volatile demand cycles. When a new generic hits the market-say, a generic version of a popular cholesterol drug-the brand-name version’s sales can drop 80% in six weeks. If your inventory system doesn’t react, you’re left with $10,000 worth of obsolete brand-name stock and no way to refill the new generic fast enough.

That’s why static inventory rules fail. You can’t just order 100 bottles of atorvastatin every month because you did last month. You need to track turnover rates, lead times, and seasonal spikes. A study by Clotouch found pharmacies using data-driven generic stocking saw a 15% drop in stockouts and a 10% reduction in holding costs. That’s not luck-it’s math.

The Two Numbers That Control Your Generic Inventory

Every pharmacy needs two non-negotiable numbers for each generic drug: the Reorder Point (ROP) and the Reorder Quantity (ROQ).

ROP tells you when to order. It’s calculated as: (Average Daily Usage × Lead Time in Days) + Safety Stock. For example, if you sell 5 bottles of metformin a day, your supplier takes 3 days to deliver, and you want a 2-day safety buffer, your ROP is (5 × 3) + 10 = 25 bottles. When stock hits 25, you order.

ROQ tells you how much to order. The Economic Order Quantity (EOQ) model balances ordering costs and holding costs. For most pharmacies, ROQ for fast-moving generics like ibuprofen or omeprazole is usually enough for 7-10 days of sales. Slow-movers like rare thyroid meds? Order just enough to cover 30 days. Overstocking slow-movers is the fastest way to turn profit into waste.

Pharmacies that use this method report 12-18% higher inventory turnover. That means your money isn’t sitting in bottles-it’s turning over into cash.

Dynamic Minimum-Maximum: The Secret Weapon for Independents

Large chains use AI to predict demand. Most independents can’t afford that. But there’s a simple, powerful alternative: the minimum-maximum system.

Set a minimum stock level-the point at which you reorder-and a maximum-the most you’ll ever hold. For example:

- Metformin 500mg: Min = 30 bottles, Max = 70 bottles

- Simvastatin 20mg: Min = 15 bottles, Max = 40 bottles

- Levothyroxine 50mcg: Min = 8 bottles, Max = 20 bottles

When stock hits the minimum, you order enough to bring it back up to the maximum. No guesswork. No monthly budgets. Just rules.

This works because generics have predictable demand patterns. Fast movers need higher max levels. Slow movers? Keep max low. The key is reviewing these levels every 4-6 weeks. If metformin sales jump from 5 to 8 bottles a day after a flu season, raise the max. If a new generic enters and your brand-name lisinopril sales drop by half, lower the max immediately.

How to Handle New Generic Entries Without Losing Money

New generics don’t just appear-they explode. One day, your pharmacy sells 12 bottles of brand-name Lipitor. The next, the FDA approves a generic, and 9 out of 10 patients ask for it. If your system doesn’t auto-adjust, you’re stuck with 300 bottles of a drug that’s now obsolete.

The fix? A generic transition protocol.

- When a new generic is approved, reduce the max stock of the brand-name version by 50% within 48 hours.

- Set the new generic’s initial max stock to 20% of what the brand-name version was selling at.

- Track sales daily for the first two weeks. If demand hits 80% of the old brand’s volume, raise the max to match.

- Use your supplier’s alerts-many now notify you of upcoming generic approvals.

One pharmacy in Ohio used this method during the atorvastatin transition and avoided $3,200 in expired brand-name inventory. That’s not a win-it’s a rescue.

Expiry Tracking: The Silent Profit Killer

Generics are cheaper to buy-but often have shorter shelf lives. Why? Because manufacturers squeeze margins. A generic blood pressure pill might expire in 18 months, while the brand-name version lasts 36. If you don’t track expiry dates by batch, you’re gambling with waste.

Implement a simple rule: First Expired, First Out (FEFO). Always pull the oldest batch first. Use your pharmacy software to flag any generic stock that’s within 60 days of expiry. Offer those to patients who need them immediately-no extra charge. If they’re not claimed within 14 days, return them to the supplier. Most wholesalers will take back unopened generics within 90 days of expiry.

Pharmacies that track expiry rigorously reduce waste by up to 25%. That’s pure profit.

Staff Training: The Missing Piece

Even the best software fails if your staff doesn’t use it right. Common mistakes:

- Not scanning every generic into the system when receiving

- Forgetting to update inventory after returns or patient cancellations

- Not checking expiry dates during daily checks

Fix this with weekly 15-minute huddles. Focus on one generic each week. Example: “Last week, we had two stockouts of metformin. Why? Because we didn’t reorder when we hit 30. This week, everyone checks the ROP on the screen before closing.”

Also, train staff to return unclaimed prescriptions to stock within 24 hours. One pharmacy cut inventory discrepancies by 22% just by doing this.

What to Stock: The Top 5 Generics That Always Move

Not all generics are equal. Focus your attention on these five categories-they’re the backbone of every community pharmacy:

- Metformin - Diabetes. High volume, low cost, always in demand.

- Lisinopril - Blood pressure. One of the most prescribed drugs in the U.S.

- Atorvastatin - Cholesterol. High turnover, frequent transitions.

- Omeprazole - Heartburn. Over-the-counter equivalent sells like candy.

- Ibuprofen - Pain relief. Fastest mover in the store.

For these, keep at least 3-4 different strengths or brands on hand. Patients won’t buy if it’s the only one on the shelf. They’ll walk out.

Software Matters-But Not as Much as You Think

You don’t need a $50,000 AI system. But you do need software that does three things:

- Tracks ROP and ROQ automatically

- Flags expiry dates by batch

- Allows you to set min-max levels per drug

Look for systems with a “generic transition mode” or “therapeutic interchange alerts.” Pharmacies using these features report 22% higher satisfaction. Avoid software that treats generics like brand-name drugs-same settings, same rules. They’re not the same.

Final Rule: Keep a Week’s Supply for Fast Movers

There’s one golden rule for fast-moving generics: Never let your stock dip below a week’s supply. That’s 7 days of average sales.

Why? Because if you run out of metformin, your diabetic patient doesn’t wait. They go to the grocery store pharmacy. Or they skip doses. Or they switch to a different pharmacy. You lose them for good.

For slow-movers, keep 30 days max. For fast-movers, keep 7-10. It’s simple. It’s proven. And it’s the difference between surviving and thriving.

How often should I review my generic inventory levels?

Review your min-max levels and reorder points every 4-6 weeks. During major generic transitions-like when a new generic enters the market-review weekly for the first month. Use sales data, not gut feeling. If metformin sales jumped 30% last month, adjust your max. Don’t wait for a stockout to act.

Can I use the same inventory rules for brand-name and generic drugs?

No. Brand-name drugs often have stable, predictable demand and longer shelf lives. Generics have volatile demand, shorter expiry dates, and frequent market shifts. Use higher reorder frequencies and lower max levels for generics. Never apply brand-name inventory rules to generics-it leads to overstock and waste.

What’s the biggest mistake pharmacies make with generic inventory?

The biggest mistake is ignoring expiry dates and overstocking slow-moving generics. Many pharmacies buy in bulk to save money per unit-but end up throwing away $5,000 a year in expired stock. Generics are cheaper to buy, but not cheaper to hold. Always prioritize turnover over bulk discounts.

How do I handle a sudden surge in demand for a generic?

If a generic suddenly sells out, check your ROP. Did you set it too high? Adjust the average daily usage in your system and lower the reorder point. Also, contact your supplier-many offer emergency shipments for high-demand generics. In the short term, offer a therapeutic alternative (with prescriber approval) to keep patients covered.

Should I stock multiple brands of the same generic?

Yes-for fast-moving generics. Patients may prefer one brand over another due to pill shape, color, or past experience. Stock at least two brands of metformin, ibuprofen, or omeprazole. It reduces lost sales and builds loyalty. For slow-movers, one brand is enough.

What’s Next?

If you’re still using monthly budget-based ordering for generics, you’re leaving money on the table. Start small: pick one high-volume generic-metformin or lisinopril-and implement the min-max system this week. Track your stockouts and waste for the next 30 days. You’ll see the difference.

The future of pharmacy isn’t about selling more drugs. It’s about managing less inventory-more efficiently, more smartly, and with less waste. That’s how you survive the squeeze of rising costs and shrinking margins. That’s how you stay in business.

jeremy carroll

December 15, 2025 AT 05:46