Every year, your insurance plan changes-sometimes quietly, sometimes with a shock. In 2025, those changes are bigger than ever. If you’re on Medicare Part D or any prescription drug plan, you’re likely to see your medications moved, swapped, or even dropped from coverage. The reason? The Inflation Reduction Act of 2022 is now fully in effect, forcing insurers to rethink how they cover drugs. For many people, that means switching to generics or biosimilars. It’s not about cutting corners-it’s about reshaping how billions in drug spending are handled. And if you don’t know what’s coming, you could end up paying more-or worse, running out of medicine.

What’s Actually Changing in 2025?

Starting January 1, 2025, Medicare Part D plans can no longer make you pay through the nose in the so-called "donut hole." That gap is gone. Instead, once you hit $5,030 in out-of-pocket spending this year, you get 100% coverage until you hit $8,000. After that, you pay just 5% coinsurance. That alone saves millions. But here’s the catch: to make room for those savings, insurers are tightening their formularies.

A formulary is just a list of drugs your plan covers. And it’s not static. Each year, pharmacy benefit managers (PBMs) like CVS Caremark, OptumRx, and Express Scripts update it. In 2025, they’re doing it aggressively. The goal? Push patients toward cheaper alternatives-especially generics and biosimilars. Why? Because they’re cheaper, and the law now rewards plans that use them.

For example, Tier 1 drugs are now mostly generics. Copays? Usually $1 to $10. Tier 2? Non-preferred generics and some brands-around $47. Tier 3? Non-preferred brands-$113. And specialty drugs? They’re still expensive, but even those are being replaced. Take Humira, the top-selling biologic for arthritis. Its biosimilar, Amjevita, now costs 70% less. Many plans are switching patients over without asking. That’s called non-medical switching. And it’s up 23% since last year.

Why Are Biosimilars Suddenly Everywhere?

You might hear "biosimilar" and think it’s a knockoff. It’s not. A biosimilar is a highly similar version of a biologic drug-like Humira, Enbrel, or Stelara. They’re made from living cells, not chemicals, so they’re complex. But they work the same way. The FDA approves them only after proving they’re just as safe and effective.

In 2024, 17 new biosimilars got approved. That’s a 34% jump from 2023. And insurers are rushing to add them. Why? Because they can save patients hundreds a month. One user on HealthUnlocked switched from Humira to Amjevita and saved $450 a month-with zero side effects. That’s the kind of win PBMs love.

But here’s the twist: you don’t need to be told you’re switching. As long as the biosimilar is on the formulary, your plan can swap it in automatically. The FDA now says even non-interchangeable biosimilars can be used without a doctor’s approval. That’s new. And it’s accelerating the shift. By 2027, experts predict nearly half of targeted biologic treatments will be biosimilars.

What Drugs Are Being Dropped?

Not all drugs are being kept. In 2025, CVS Caremark removed nine specialty drugs from its formulary-including Herzuma and Ogivri, two cancer treatments. They replaced them with newer biosimilars like Kanjinti and Trazimera. UnitedHealthcare moved Humalog insulin to a higher tier, raising copays from $35 to $113 overnight. That’s not rare. It’s standard practice now.

Plans are also cutting older brand-name drugs that have cheaper generics available. For example, if you’re on a brand-name statin like Crestor, your plan might push you to generic rosuvastatin. Same drug, same effect, 90% cheaper. If you’re on a brand-name diabetes pill like Januvia, you might get switched to generic sitagliptin. It’s not a bad thing-unless you’ve been stable on the brand for years and suddenly get no warning.

Plans must give you 60 days’ notice before dropping a drug you’re already taking. But if a new generic comes out, they can swap it in with just 30 days’ notice. That’s a loophole many patients don’t know about.

How to Spot Changes Before They Hit You

You won’t always get a letter. Sometimes, you’ll only find out when your pharmacy says, "We don’t carry that anymore." That’s why you need to check your formulary yourself.

Between October and December each year, insurers release their new formularies. Log into your plan’s website. Look for "Formulary Changes 2025" or "Summary of Benefits." Download the full list. Search for every drug you take. If it’s missing, moved to a higher tier, or marked "requires prior authorization," you need to act.

Don’t wait. Talk to your pharmacist. They know what’s changing and what alternatives exist. Ask: "Is there a generic or biosimilar that’s covered?" If your drug is being dropped, your doctor can file an exception. In 2024, 82% of tier change requests were approved. But if the drug is completely removed? Only 47% of requests got through.

What to Do If Your Drug Is Removed or Switched

If your medication is taken off the formulary, you have options:

- Request an exception: Your doctor submits a form saying why you need the original drug. For urgent cases, like if you’re at risk of hospitalization, you can get a decision in 24 hours.

- Ask for a transitional supply: If you’ve been on a drug for more than 90 days, you’re entitled to a 30-day supply even after it’s removed. This gives you time to appeal or switch.

- Switch to a biosimilar: If your plan offers one, ask your doctor if it’s right for you. Most people tolerate them fine. Studies show no difference in effectiveness for arthritis, diabetes, or Crohn’s patients.

- Switch plans: During Open Enrollment (October 15-December 7), you can change to a plan that still covers your drug. But don’t assume your current plan will keep it next year.

Remember: your doctor’s job isn’t just to prescribe. It’s to advocate. If your plan denies your exception, ask your doctor to call the insurer. Many times, a simple phone call reverses the decision.

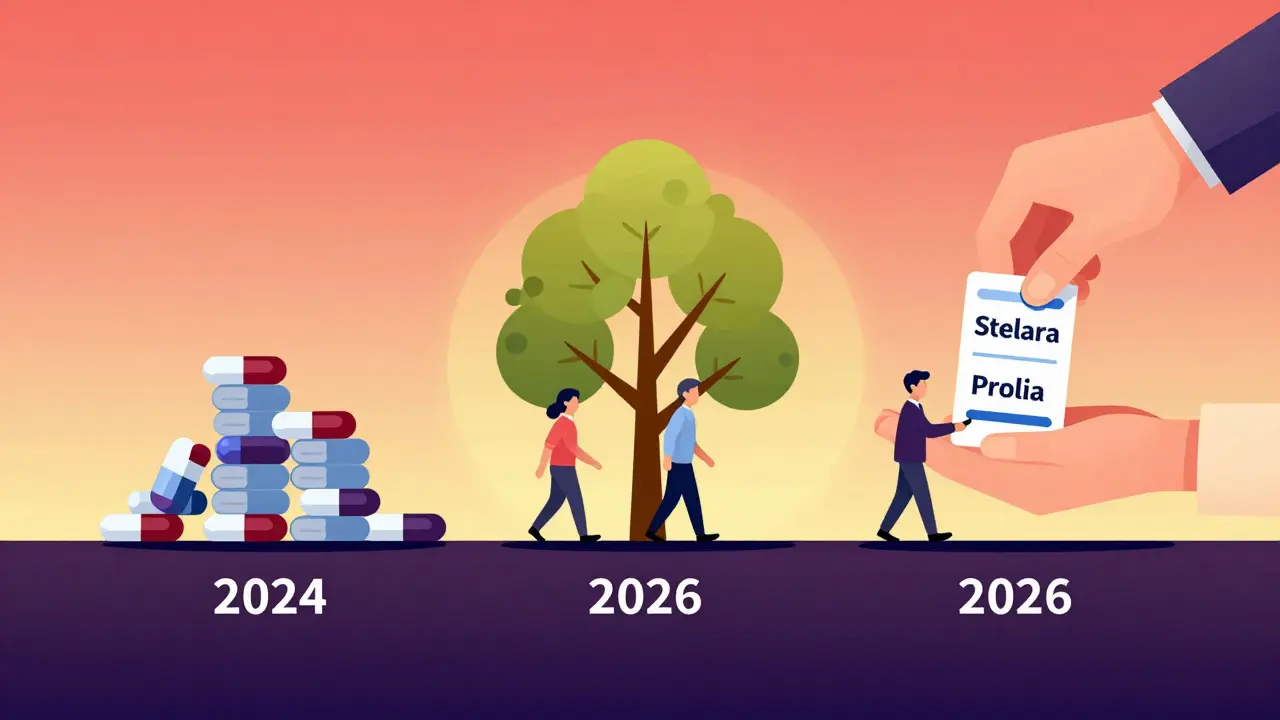

What’s Coming in 2026?

The big news isn’t in 2025-it’s in 2026. The Medicare Drug Price Negotiation Program kicks in. For the first time ever, the government will negotiate prices on 10 high-cost drugs. The first batch includes Stelara, Prolia, and Xolair. Starting January 1, 2026, every Part D plan must cover these drugs at the negotiated price. That’s huge. It means you’ll pay less, and insurers can’t exclude them anymore.

And guess what? Biosimilars for these drugs are already in the pipeline. By mid-2025, you’ll likely see them appear on formularies. That means even more switches. But this time, you’ll be getting a better deal.

Who’s Most at Risk?

Not everyone is affected equally. People with chronic conditions-diabetes, arthritis, autoimmune diseases-are hit hardest. These are the drugs most likely to be switched. Seniors on fixed incomes are vulnerable too. A $113 copay on insulin or a biologic can mean skipping meals.

One in three people affected by formulary changes report a delay in filling their prescription. That’s dangerous. One Reddit user said their Humalog switch caused a two-week gap. They ended up in the ER. That’s not an outlier. It’s a pattern.

But here’s the good news: if you act early, you can avoid this. The $2,000 out-of-pocket cap in 2025 means your worst-case scenario is now capped. You won’t pay more than that for drugs all year. That’s a massive safety net.

Final Advice: Don’t Wait for the Letter

Insurance changes aren’t going away. They’re getting faster, smarter, and more aggressive. But you’re not powerless. The tools are there: formularies, exceptions, pharmacists, doctors, and new laws that protect you.

Do this now: check your plan’s 2025 formulary. Write down every drug you take. Look up each one. If it’s gone, moved, or restricted, call your pharmacist. Ask your doctor about alternatives. Don’t assume your plan has your back. They’re balancing budgets. You’re balancing health.

Generic switching isn’t the enemy. It’s the future. And if you’re ready for it, you’ll save money, not suffer.

Abby Polhill

December 23, 2025 AT 19:16